There’s been a lot of talk about the impact on entrepreneurship of well-chronicled flameouts like Theranos and WeWork.

More specifically, there are female founders who believe Elizabeth Holmes’ otherworldly hyperbole has subjected them to more intense scrutiny (if that’s even possible).

There are also foreign nationals trying to raise money who feel like WeWork’s Israeli-born cofounder, Adam Neumann, has inflamed suspicions of immigrant founders.

But I’m seeing something a touch more pervasive, and arguably a bit more insidious.

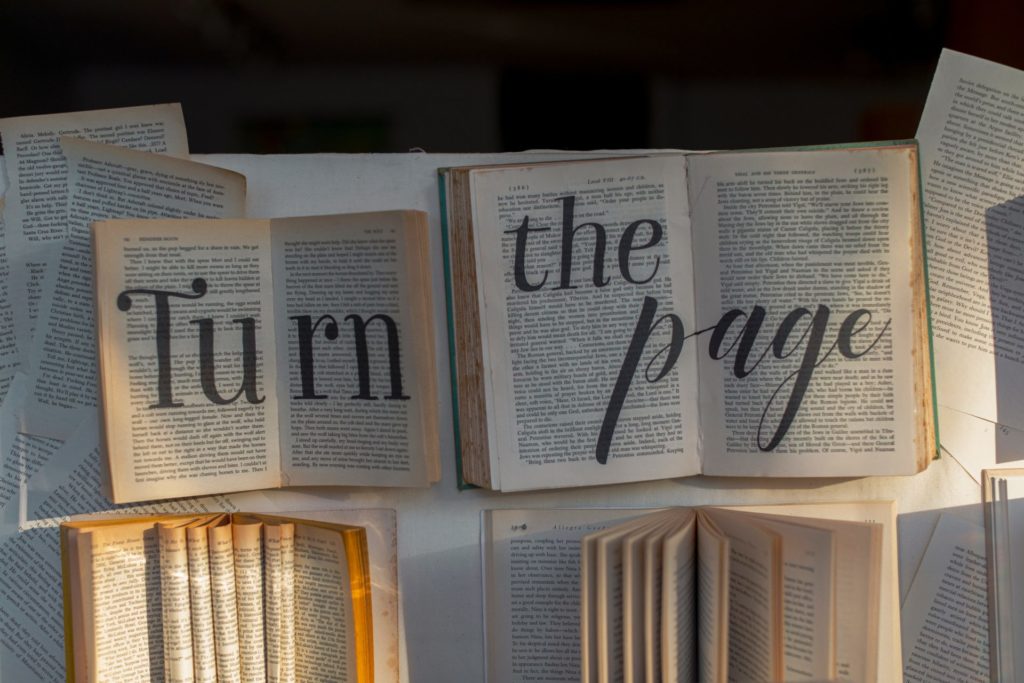

A backlash against storytelling itself.

Just to be clear, I don’t see any of this pushback from seasoned investors. They all know that storytelling is of paramount importance.

Rather, I’ve been hearing it from finance experts and, most worryingly, from officers and directors.

Some push back on my admonition that smaller public companies need to be great storytellers to garner premium valuations.

Others equate great storytelling with being “story-driven” (i.e., promotional), and insinuate that public companies need only excel at their businesses to tell their stories.

Yup. That works all the time with small-cap stocks.

Whether it’s SPAC detritus, fictional VC valuations, meme stocks, or ethically-challenged politicians, the sheer volume of nonsense has convinced some executives that “storytelling” = “lies.”

In reality, storytelling is the art and science of educating existing and potential stakeholders about a company’s values, mission, and performance. It’s about persuading newcomers to learn more about what a company’s doing, and it’s about re-energizing those who are already vested in its success to remain ensconced or become even more involved.

Storytelling is only tantamount to “tall tales,” when the authors are… untruthful. Fortunately, the percentage of card-carrying charlatans is quite low; it’s just that their whoppers tend to be newsworthy.

Pro tip: If someone tells you that storytelling isn’t important to nascent growth companies, you’re on notice that they’ve never successfully built or invested in one.