Predicting the future is a fool’s errand. But I can say with 100 percent certainty that 50 years from now, small-cap companies will continue to issue press releases that try – in vain – to obfuscate that their recent financial results underperformed investor expectations.

As a former institutional investor, who has also advised many pre-IPO and small-cap boards, I think I’ve seen most of the variations by now.

- The extensive use of italicized headline subtitles that exhaustively call attention to everything remotely possible going on in the company – other than, you know, the results.

- The earnest, 500-word quote from the CEO setting forth how “unbelievably excited” they are about some of the “extremely transformative” things the company is working on that make them “incredibly optimistic.”

- Fawning over non-GAAP results, and even discussing them to the exclusion of GAAP results.

- Changing the comparative reporting periods to opportunistically highlight sequential results, since the year over year comparisons are bad.

- Introducing completely new reporting metrics – just for the quarter – to highlight results that might distract investors from the results they actually care about.

- Lengthy, bullet-pointed lists of “business highlights” that are predominantly comprised of immaterial information.

- The poignantly timed introduction of sweeping new initiatives that investors don’t hear much about thereafter.

- Notice that authorization is being sought for a stock buyback – typically of an inconsequential number of shares, or in companies that have no EPS, or worse, in companies that subsequently issue new shares in a capital raise.

- Long-winded quotes from other officers confirming all of the foregoing.

Here are three frank takeaways for officers and directors to consider in this regard.

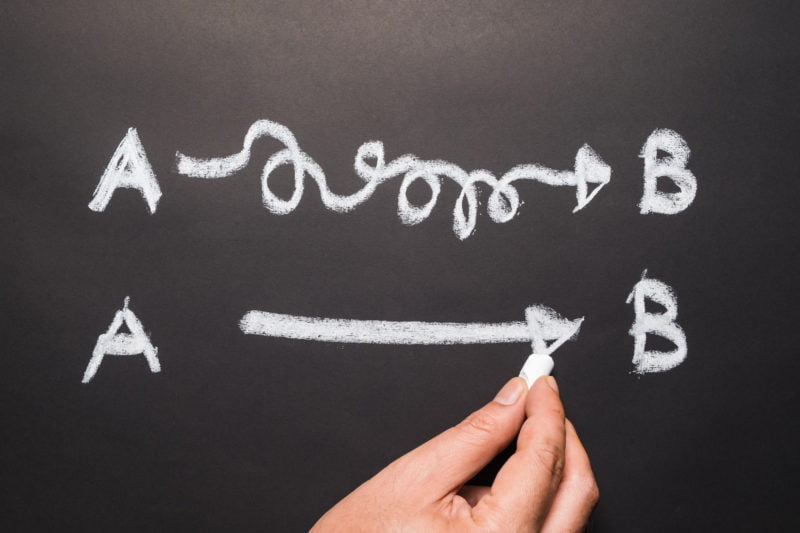

It doesn’t work. Smart investors have seen this movie before, and it ends badly. Every public company has bad quarters. Great companies face bad news directly, and succinctly, because nothing they say is going to undo the bad results. Every other path destroys trust and erodes value.

Modifiers. Great companies communicate factually, and deliver transparent financial results. It’s up to investors to determine whether the results are “super exciting,” “game-changing,” or “paradigm shifting.” Great CEOs rarely use that language, because experienced investors all know that the use of modifiers is almost always inversely proportional to corporate performance.

Proof. If service providers are cajoling your company into this type of communication, ask them to show you examples of companies that have succeeded over the long term in this regard. It will be a brief conversation.

Sometimes companies have bad quarters, but things are actually going well on many different fronts, and officers and directors are legitimately confident in the company’s future.

If that’s the case: (1) let future results speak for themselves when announced; and (2) in the meantime, consider buying stock in the open market.

This post was originally published on LinkedIn Pulse.

________________