Small-Cap Audit Firm Selection: Think Like an Institutional Investor

There are a handful of firms that perform the vast majority of audit work for the Fortune 1000. For the approximately 80 percent of U.S. public companies that have market capitalizations of less than $500 million, there are literally hundreds of audit firms from which to choose. With so many choices, how can the audit firm […]

Required Reading: Deloitte’s 2017 Board Diversity Survey

The Deloitte 2017 Board Diversity Survey (the “Survey”) is fascinating, and should be required reading for anyone interested in corporate oversight. Several months ago I wrote about the fact that thought diversity in America’s boardrooms simply can’t take place until search firms and nominating and governance committee chairs stop limiting their new board member searches to a needlessly shallow […]

Considerations for High-Growth Company Boards in 2018

Governing pre-initial public offering (IPO) and small-cap public companies is a radically different challenge than governing enterprise-scale companies. In the year ahead, boards of high-growth companies will be considering some of the critical issues outlined below that are unique to their ecosystems. Pre-IPO Companies There are two different kinds of pre-IPO companies in today’s marketplace: […]

Boards Should Stop Overlooking U.S. Veterans

I’ve never served our country in the military, but occasionally I have the honor of advising United States veterans who are looking for board seats. CEOs and board members constantly ask me whether I could recommend a value-added director for their boards, yet the number of immensely qualified veterans unsuccessfully looking to serve on boards continues […]

Corporate Governance Needs An Image Consultant

Few who have seen it can forget the iconic scene in the 1987 movie Wall Street when Michael Douglas’ character Gordon Gekko stands up, microphone in hand, at Teldar Paper’s shareholder meeting and says: “The point is, ladies and gentlemen, that greed, for lack of a better word, is good. Greed is right, greed works.” […]

Book Review: “Director’s Handbook: A Field Guide to 101 Situations Commonly Encountered in the Boardroom”

In March 2017, I wrote a guest commentary in the ABA Business Law Section’s Corporate Governance Committee publication (Insight) entitled, “The Erosion of Boardroom Lawyering.” In that piece, I observed an incongruity in the U.S. capital markets; that is, a growing number of boardroom lawyers seem fixated upon “box checking” and “culpability avoidance,” whereas stakeholders […]

How Onboarding Positions Small-Cap Boards For Success

I once heard a small-cap director lament that governing her diminutive, resource-constrained company was like running on a treadmill that keeps tilting upwards and incrementally speeding up to the point she’s worried that she will be thrown off. For many small-cap companies, it’s an apt metaphor. When those companies also fail to provide any orientation […]

A Dangerous Boardroom Assumption That Hamstrings CEO Capital Markets Success

In a classic Catch-22, many small-cap directors, who may be inexperienced with capital markets themselves, assume their CEO “has the Street stuff covered.” When neither party feels safe to admit that they need to learn more, those assumptions perpetuate, often at the expense of shareholders. The overwhelming majority of public companies are small-caps, and many […]

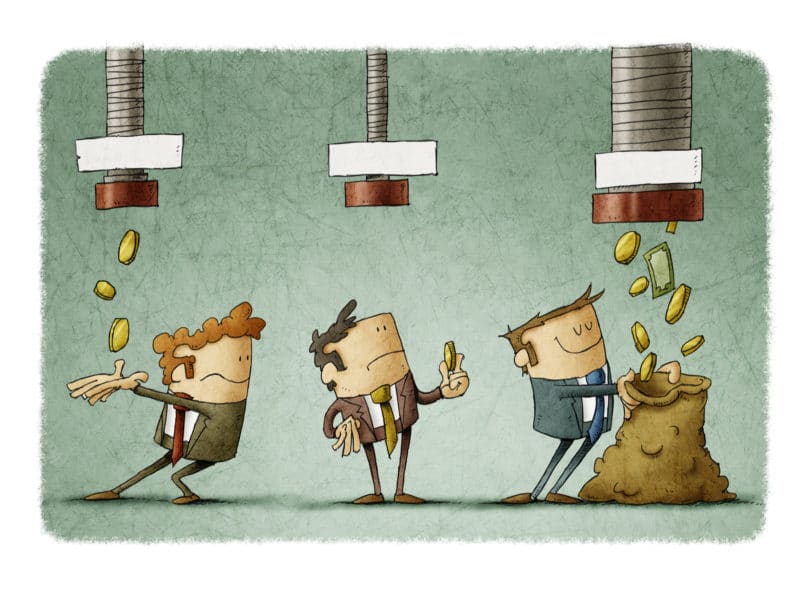

Board Composition: A Big Reason Small-Caps Undertake Bad Financings

Board composition is critical, especially for small-caps. It’s a balancing act between cost constraints and jeopardizing shareholder value. Needlessly dilutive financings often have their roots in critical gaps in boardroom experience. Much is said and written about initial public offerings in this country from seemingly every possible angle. Interestingly, though, there is an equally important financing […]

Attention Small-Cap CEOs: Speak Like Your Share Price Depends On It

Recently, a family friend asked me to provide some feedback with respect to corporate messaging (he’s the CEO of a company that’s anticipating an IPO in 2018). As part of the informal engagement, I listened to him undertake a mock investor roadshow presentation (with Q&A) and a mock quarterly earnings call. Succinctly, my reaction to […]